Wednesday 29th November brought the market an early Christmas present, with record cleared

volumes on Capesize contracts with 19,057 lots across the Cape TC, options and C5 route. Alongside

this there has also been the largest jump in the spot rates since 2010, with rates jumping over $7,000

from $34,656 to $41,796/day on the C5TC index.

There is a range of reasons for this. Firstly, there is the growth of financial market players that have

helped bring new liquidity to the market.

Next seasonality, with the post rainy season pick up in flows of bauxite have bolstered volumes on

derivatives. Both Vale and Australian volumes have been higher than expected, jumping up before

year end. Low iron ore stocks and restocking efforts in China are sucking in raw materials, even

against the backdrop of concern about the Chinese property market.

This situation has been exacerbated by the limited number of ballasters as a red-hot Pacific market is

keeping vessels tied up and not transferring to the Atlantic in search of cargos.

Smaller vessel sizes have helped support the Cape values as the market is tight with the low water

levels in the Panama Canal having a big effect on rates. There is also a weather factor impacting the

Pacific trade, with poor weather conditions helping increase congestion.

But like a giddy child staring at the Christmas presents under the tree, will this beat what happened

in 2008? Digging into the FIS archive, there are some pre-2010 memories to remember.

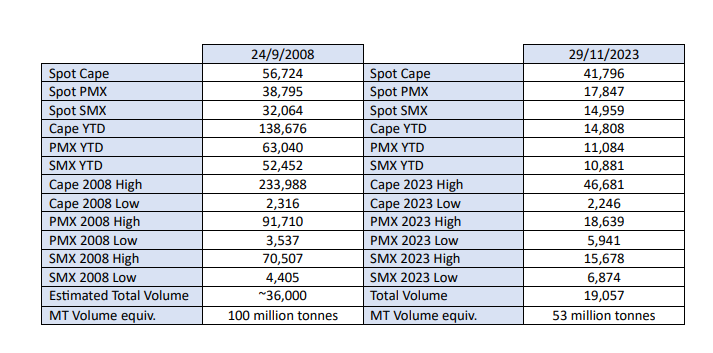

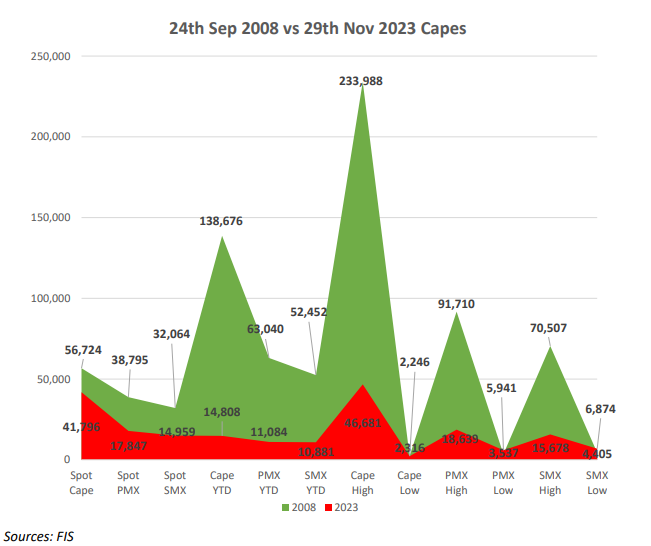

On the 24th September 2008 spot Cape rates were at $56,724/day, with a YTD of $138,676/day,

having been at a year high of $233,988/day. Compare this to Wednesday’s spot of $41,796, YTD of

$14,959 and year high of $46,681. The highest value trade for FIS on that day was a Sep-Dec strip at

$80,000/day. Compare that to a Dec-Feb strip today valued at $20,450/day.

Taking a look at volumes on that day in 2008, it was a record day for FIS volumes and a projected

traded market volume 36,000 lots of Cape contracts. The first cleared trade was on LCH in 2005

before a big rise in cleared trading after the 2008 price crash. On the 24th September over 90% of

trading had moved to cleared and a small percentage still remaining OTC traded.

LCH, Nasdaq, and SGX were the exchanges at the time with a mixture of cleared and OTC trades,

which has consolidated to just two today in EEX and SGX and almost exclusively cleared trading.

Comparing the volumes from the 29th November 2023 and 24th September 2008 amounts to an equivalent of 53 million tonnes and 100 million tonnes respectively.

So, comparing this year’s Christmas present to 2008, 2008 wins on size. Let’s hope that the good

presents keep coming and 2024 is the biggest yet.